How Stripe's embedded finance products are powerful building blocks for startup founders

The "AWS of fintech" is finally here

In 2015, my cofounder and I built an ML-enabled accounting startup.

There was no “AWS of fintech” back then, and we faced friction at every step: integrating with our customers’ revenue pipelines, bank accounts, and credit card transactions. Getting a fintech company off the ground was slow and brutal.

But in the past few months, that’s all changed! At their Sessions conference last month, Stripe detailed their embedded finance products, which are a complete gamechanger for startup founders.

⭐️ Stripe’s new tools have greatly expanded the scope of startups that can be built, and founders need to pay attention.

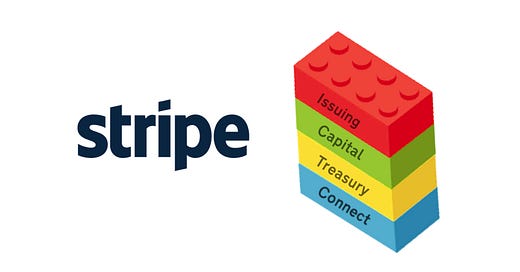

Stripe’s building blocks

Most startup founders think of Stripe as a “way to take payments”, but their recent products are moving toward something much larger: creating the infrastructure for your company to offer financial services to your customers.

This is critical. Before, if your startup wanted to offer financial services to your customers, you’d have to:

Build your own bank relationships before you could offer your customers a way to hold or transfer funds through your product.

Underwrite your own loans and build in complex compliance mechanisms before you could offer a loan through your platform.

Set up contracts with card issuing companies before you could launch a debit/credit card for your customers.

With Stripe’s embedded finance products, you can:

Create instant bank accounts for your customers through Treasury. Since Stripe maintains relationships with the banks on the back-end, your startup wouldn’t need to.

Immediately offer business loans to your customers through Capital for Platforms. Stripe handles compliance, underwriting, issuing of the loan, and even absorbs the credit risk.

Let your customers create cards off the bat with Issuing. Stripe handles the creation of the cards (both virtual and physical), and you can build in code to customize the card behavior for your customers.

Now you can see why these embedded finance products are so exciting! As a startup founder, you can piece together these building blocks to build financial-enabled products in a fraction of the time it would have taken before.

Startups that you can quickly build

🛍 The Shopify for X

Shopify is a general-purpose e-commerce platform that lets anyone easily create an online store, market products, take payments, and borrow capital.

But what if you’re targeting a market that has very specific needs that Shopify doesn’t address? Now you can quickly build a Shopify-like product tailored to your market vertical:

👩🏽💼 Your secret sauce

You focus on making the most easy-to-use store building tools for your market niche, along with a simple onboarding flow and quick-start templates.

————————-

🔀 Stripe Connect

You add in Stripe Connect so your customers can start charging for their products.

🏦 Stripe Treasury

You create bank-like accounts for your customers when they sign up, so they can store and access their funds, and pay their vendors’ bills through ACH.

📈 Stripe Capital

By measuring your customers’ sales (through Connect) and cash reserves (through Treasury), Stripe Capital lets you issue financing to your customers, and earn revenue on each loan extended — in addition to your core SaaS revenue.

📈 Quickbooks for X

QuickBooks creates general-purpose accounting software for small businesses, and I can tell you from experience that companies — especially internet-native ones — have drastically different accounting needs.

Here’s how you could create a QuickBooks for a specific industry vertical:

👩🏽💼 Your secret sauce

You focus on creating an intuitive accounting interface, with code to handle your market’s unique bookeeping needs like revenue recognition and depreciation.

————————-

🔀 Stripe Connect

Set your customers up with Stripe for payments, so you can use Connect to pull in and categorize their revenue flow while reconciling their received payments with outstanding invoices in your accounting backend.

🏦 Stripe Treasury

Set your customers up with a Treasury account. Now you can easily account for their bill payments and payroll outflow, while reconciling cash flows with their accounts payables and receivables.

💳 Stripe Issuing

Use Issuing to let your customers create expense cards for their employees. Now instead of constantly asking your customers what a specific charge was, you can use the geolocation of the transaction to help categorize it in your software.

🏦 Clearbanc for X

Clearbanc extends growth capital to startups in the form of merchant cash advances, with fees that depend on how the capital is used (e.g. marketing-spend).

Business lending is a massive market, but by focusing on a specific vertical (like Karat for creators), you can build a lending startup and tailor your loans, rewards, and repayment structures for your market niche.

👩🏽💼 Your secret sauce

You focus on building the analytics tools to help your customers understand their revenue flow, and the interface to let them apply for (and service) a loan. You can also decide a fee structure based on how they are spending the capital.

————————-

💳 Stripe Issuing

Set up your customers with cards through Stripe Issuing when they get approved for the loan, so you can set programmatic controls on how they spend the money.

📈 Stripe Capital

Integrate with Stripe Capital to build your lending flow. Since Stripe handles the compliance, credit risk assessment, and loan disbursements, you can focus instead on building tools to help your customers use those funds in a way that provides them the highest ROI.

🔀 Stripe Connect

Onboard your customers to Stripe Connect, and let Stripe handle disbursement of the funds and collecting repayment. This also lets you access their revenue flow to build your core analytics product.

🚀 The next level of fintech

Now you see why Stripe’s new products are so exciting for startup founders: they take complex financial infrastructure and expose them to entrepreneurs as tools to build with, similar to AWS democratizing access to the cloud, or TensorFlow simplifying the process of integrating machine learning into new products.

The door has just blown wide open for new startups that can be built on these primitives, and I’m excited to see how founders piece them together to create completely new products and business models!

👋 Hello, I’m Ashwin. I’m a startup investor, founder, and software engineer. I’ve worked with hundreds of founders to help them craft the perfect pitch for fundraising. I’ll be writing articles like this weekly, so subscribe to stay in the loop!